Computer Web Payment

Merchants with online websites (such as online shopping centers, ticketing sites, top-up platforms, etc.) can refer to the solutions provided in this section to access PayCloud payment services.

Integration Description

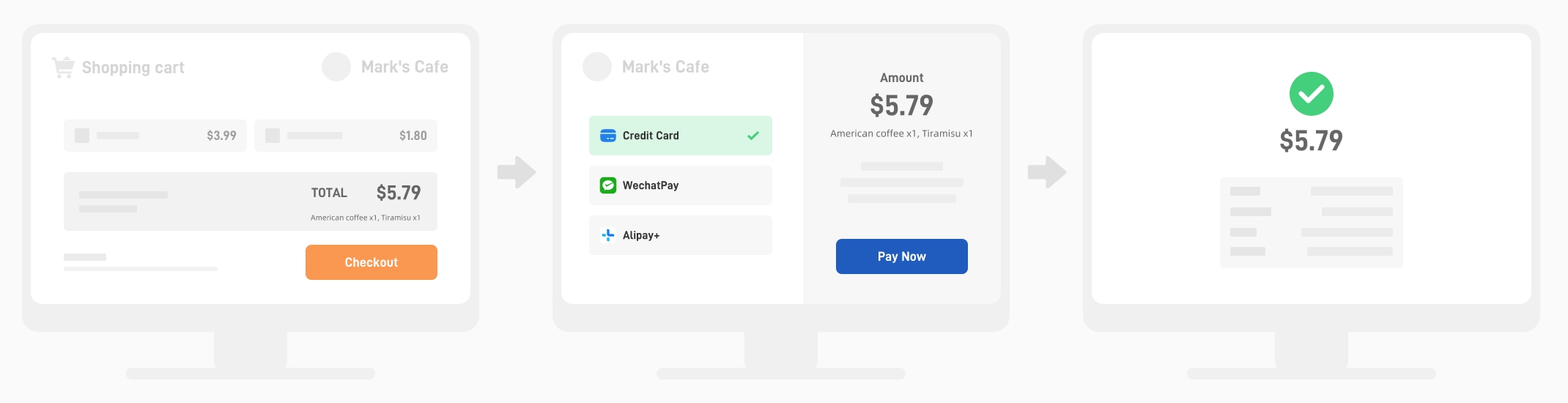

E-commerce/computer web payment is a payment product where merchants display goods or services on a webpage. When users select a payment method on the merchant's page, the browser automatically redirects to the PayCloud online cashier to complete the payment. Merchants can integrate this product via APIs provided by PayCloud.

The PayCloud online cashier integrates numerous banks/acquirers/third-party payment service providers' payment services, including online bank card payments, mobile wallet account payments, and mobile wallet scan-to-pay.

After completing the payment, merchants receive payment notifications from PayCloud and can proactively call the order query interface to obtain payment results. Upon receiving the payment result, PayCloud synchronizes and updates the order information for the merchant to complete the remaining product and service processes.

When placing an order, if no payment method (pay_method_id) is passed, users will be redirected to the PayCloud cashier's payment method selection page. Although this approach reduces development workload, we still recommend developing and hosting your own cashier page. This ensures a consistent payment experience for users and mitigates risks associated with domain blocking that could prevent access to the payment page.

Merchants using WeChat Pay, Alipay+ must ensure that online payment permissions have been enabled when calling this interface.

Use Case

Development Guide

We provide a set of REST APIs; please refer to the table below. These APIs offer SDKs in several languages; visit SDK section.

| API Name | Description |

|---|---|

| PC Web Payment Order | Submit a payment order via this API |

| Cancel Order | Close unpaid orders through this api and refund the user if payment has already occurred |

| Submit a refund request | If you submit a refund request through this API and the refund does not arrive immediately, you can call the refund inquiry API to get the progress of the refund. |

| Query order | Query the transaction result (consumption/pre-authorization/pre-authorization completion) of a positive transaction order through this API |

| Query refund | Query the transaction results of negative transaction orders (consumption cancellation/pre-authorization cancellation/consumption refund/pre-authorization completion refund) through this API |

| Transaction result notification | After the transaction, notify the merchant through this webhook to tell the merchant the result of the transaction |

Implementing Computer Web Payment Through Offline QR Code Payments

For merchants who have not applied for online payment services, you can utilize the offline QR code payment interface. By converting the obtained QR code string into a QR code image and displaying it on your webpage, you can guide users to pay via their mobile wallet apps by scanning the code.

Key considerations for implementing QR code payments:

-

Short Validity Period: Given that the validity period of an offline QR code typically does not exceed 90 seconds, include an automatic refresh function for the QR code. Before refreshing, always check if the order has already been paid to avoid duplicate payments.

-

Support for Order Cancellation: Some payment methods support the cancellation of orders. If necessary, call the cancellation API before refreshing the QR code.

While this method extends offline business operations to online scenarios, it carries risks. Banks and acquirers may deem such operations as non-compliant. Use this approach with caution to avoid potential restrictions or penalties.